Presto is Malaysia’s first homegrown multi-service lifestyle app that offers various lifestyle and convenient features, including hassle-free mobile payments. Earn and redeem Loyalty Points upon checking out. Save more, earn more!

Presto’s mission is to enhance users’ digital experience and bring convenience to their lives through one inclusive App.

Presto allows users to perform daily tasks faster by leveraging on the latest technology — enabling users to live a cooler life and get richer via smart spending.

No. They will never expire. It is just like your bank account balance!

Top up your PrestoPay and you can use your wallet credit to purchase selected items by selecting [PrestoPay] as your payment method during checkout process. You can also utilize your PrestoPay Credits for purchase by selecting [Credits] as your payment method.

i. Tap [Forgot Your Password]

ii. Enter your mobile number which you’ve used to register Presto account

iii. Enter your email address which you’ve used to register Presto account

iv. Follow the steps for new password set up

v. Receive an OTP PIN to verify your request

vi. Follow the steps for new password set up

Email us at https://www.prestouniverse.com/my/contact-us available Monday to Friday from 9am to 6:30pm.

If you would like to grow your business by accepting payment via PrestoPay, please contact our team at https://www.prestouniverse.com/my/contact-us.

PrestoPay is a unique mobile wallet within the Presto app. The most distinctive feature of PrestoPay is that it allows users to pay and earn loyalty points such as BonusLink Points and airasia points in multiple ways. PrestoPay can also be used to send money, buy movie tickets, shop online and in-stores—and more!

i. Top up – Top up your PrestoPay with Debit Cards issued by Malaysian banks

ii. Scan - Make payment to participating merchants by scanning the QR Code provided

iii. QR Pay - Show your QR Code to participating merchants for scanning when you want to make payment, it is as easy as that!

iv. Lucky Money – Send money to more than one person by splitting the amount of lucky money into equal or random values to a targeted number of recipients

v. Prepaid Mobile Reloads – Reload prepaid credits directly to any prepaid mobile phone number by using PrestoPay or Credits

vi. Transfer – Transfer money to your friends & family without any service charge, transaction and processing fee

vii. Withdraw – Withdraw money from PrestoPay to your Malaysian bank account. Each withdrawal incurs a withdrawal fee of RM2.00 (subject to SST) and may take up to 10 working days to be processed depending on your bank.

Basic Wallet allows you to top up your PrestoPay up to a maximum of RM500.00 without submitting any documents. Premium Wallet allows you to top up your PrestoPay up to a maximum of RM1,500.00. Also, enjoy all of PrestoPay's features when you upgrade from Basic to Premium Wallet:-

| Type of Wallet | Basic Wallet | Premium Wallet |

| Wallet Size | RM500.00 | RM1,500.00 |

| Scan & QR Pay | ✓ | ✓ |

| Withdraw | ✕ | ✓ |

| Transfer | ✕ | ✓ |

| Lucky Money | ✕ | ✓ |

Upgrade to Premium Wallet now!

To upgrade to Premium Wallet, verify your identity by submitting Know Your Customer (KYC) verification request using your Malaysian Identity Card (IC):

- Navigate to [PrestoPay]

- Tap [Upgrade]

- Select [I’m a Malaysian]

- Complete the steps by providing information as below:

- Photo of the front part of your IC

- Submit your full name as per IC and your IC number

- Photo of the back part of your IC

- Photo of your IC next to your face

We will update you on the KYC verification status within 3 working days.

To upgrade to Premium Wallet, verify your identity by submitting KYC verification request using your Passport:

- Navigate to [PrestoPay]

- Tap [Upgrade]

- Select [I’m a Foreigner]

- Complete the steps by providing information as below:

- Photo of the personal information page of your passport

- Submit your full name as per your passport, passport number, nationality, birthday and gender

- Photo of the personal information page of your passport next to your face

We will update you on the KYC verification status within 3 working days.

Account verification for Premium Wallet is a requirement by Bank Negara Malaysia. It will also help us safeguard you from financial crimes and decrease the risk of fraudulent transactions.

i. Navigate to [PrestoPay]

ii. Tap [Top Up]

iii. Choose your Top Up Method: [Debit Card issued by Malaysian banks]

iv. Follow the steps to complete the top up process

The minimum amount for top up of money into PrestoPay is RM10.00 per transaction.

The transaction limits of PrestoPay E-Wallet are as below:-.

| E-Wallet Transaction Limit | Basic Wallet | Premium Wallet |

| Per Transaction | RM500 | RM1,500 |

| Daily | RM1,000 | RM3,000 |

| *Monthly | RM4,500 | RM10,000 |

| Yearly | RM50,000 | RM50,000 |

Note: E-Wallet transactions which are subjected to transaction limits as above; include payment, withdrawal and money transfer of your E-Wallet balance.

*Withdrawal from Premium Wallet is subject to a weekly withdrawal limit of RM500.

PrestoPay Credits refers to electronic monetary credits in Presto App which may be utilized by you within the ecosystem of Presto App to perform any transaction that shall not be convertible into cash. One (1) Credits is equivalent to Ringgit Malaysia One (RM1.00) only.

|

Type of Wallet |

Basic Wallet |

Premium Wallet |

|

Wallet Size |

N/A |

N/A |

|

Scan & QR Pay |

✓ |

✓ |

|

Withdraw |

N/A | N/A |

|

Transfer |

✓ |

✓ |

|

Lucky Money |

✓ |

✓ |

The transaction limits of PrestoPay Credits are as below:-

| PrestoPay Credits Transaction Limit | Basic Wallet | Premium Wallet |

| Per Transaction | RM5,000 | RM50,000 |

| Daily | RM5,000 | RM50,000 |

| *Monthly | RM50,000 | RM200,000 |

| Yearly | RM200,000 | RM1,000,000 |

Note: PrestoPay Credits transactions which are subjected to transaction limits as above; includes payment and credits transfer of your PrestoPay Credits balance.

No. PrestoPay Credits is stored in your PrestoPay account whereby PrestoMall Credit is stored in your PrestoMall account. However, both can be utilized for purchase in PrestoMall.

You can use your PrestoPay Credits on the following services as shown above. These icons are displayed in your PrestoPay app.

Mall

Discover the best PrestoMall has to offer. Enjoy EXCLUSIVE DEALS and Lowest Price Guarantee from MADNESS SALE every day.

Mart

Enjoy the best deals PrestoMart has to offer online and offline! Head over to the nearest PrestoMart Near U outlet to indulge your taste buds with its wide selections of snacks and fresh groceries.

PrestoMart Outlets:

• PrestoMart Near U – SS15 Subang

• PrestoMart Near U – SS2 Petaling Jaya

• PrestoMart Near U – Bukit Indah Johor Bahru

• PrestoMart Near U – Batu Pahat

Food

Have food delivered to your doorstep in a few clicks via BAIJIA app.

Tickets

Cut the queue and purchase movie tickets. Not only that, but you can also even buy marathon and event tickets.

Power

Locate and rent a Power Bank near you! Offers easy rent and charge.

Gift

Conveniently purchase Presto Gift Cards to redeem PrestoPay Credits to be utilized in the available services provided in Presto.

Direct

Kickstart your E-Commerce business with PrestoDirect with zero inventory costs and tailor your vision.

You can pay to participating merchants by using [Scan] or [QR Pay] feature:-

a) Scan

i. Navigate to [Scan] on the home screen of PrestoPay

ii. Scan QR Code provided by the merchant

iii. Enter the payment amount and tap [Continue]

iv. Verify your payment details and proceed to [Confirm Payment]. You can toggle your payment method between PrestoPay and Credits by tapping [Change]

v. Authorize the transaction by entering your 6-digit PIN or Biometric Verification

vi. You will receive a payment notification of the transaction

b) QR Pay

i. Navigate to [QR Pay] on the home screen of PrestoPay. You can toggle your payment method between PrestoPay and Credits by tapping [Change] below the QR Code

ii. Show your QR Code to the merchant for scanning

iii. Verify your payment details and proceed to [Confirm Payment]

iv. Authorize the transaction by entering your 6-digit PIN or Biometric Verification*

v. You will receive a payment notification of the transaction

*NOTE: No authorization is required for payment transactions of RM100 and below, up to 5 times per day.

The payment method options available for [Scan] and [QR Pay] are:-

i. PrestoPay

ii. Credits

You can check out wih combined payment method in single transaction. Please make sure you have sufficient balance in your PrestoPay or Credits before making payment.

Your unsuccessful payment might be due to the following reasons:

i. Insufficient balance in PrestoPay or Credits

ii. Poor internet connectivity

iii. You have reached your transaction limits (refer to No.8 and 10)

i. Navigate to [PrestoPay]

ii. Tap [Transfer]

iii. Choose a recipient under your “Buddies” list

iv. Key in the amount you would like to send with the option of including a note and/ or passcode

v. Tap [Send Money]

i. Navigate to [PrestoPay]

ii. Tap [Transfer]

iii. Tap [Outside Presto]

iv. Key in the amount you would like to send with the option of including a note and/ or a passcode

v. Tap [Send Money]

vi. A link will be generated for you to share with your friends & family after you tap [Confirm]

i. Navigate to [PrestoPay]

ii. Tap [Lucky Money]

iii. Key in the total amount of Lucky Money you would like to send

iv. Key in the total number of Lucky Money packets you would like to send. You may choose to split the amount of Lucky Money per packet equally or randomly

v. Tap [Send to Presto Users] > Select users under your “Buddies” list > [Send Lucky Money]

i. Navigate to [PrestoPay]

ii. Tap [Lucky Money]

iii. Key in the total amount of Lucky Money you would like to send

iv. Key in the total number of Lucky Money packets you would like to send. You may choose to split the amount of Lucky Money per packet equally or randomly

v. Tap [Send Outside Presto] > [Send Lucky Money] > A link will be generated for you to share with your friends & family

“Pass Code” is a set of code which is created by the sender in “Enter a pass code”. It is an optional step while you transfer money to others. The recipient will need to enter the passcode from you in order to receive the money.

“Lucky Money” enables you to send money to more than one person whereas “Transfer” only allows one recipient.

We support withdrawal to local bank accounts, which means you must have a Malaysian bank account in your name, to withdraw money from PrestoPay.

i. Navigate to [PrestoPay]

ii. Tap [Withdraw]

iii. Key in the amount you would like to withdraw

iv. Select your bank

v. Key in your bank account number (Omit spaces & dashes)

vi. You must agree to the withdrawal terms before tapping [Withdraw Funds]

The withdrawal request may take up to 10 working days to be processed depending on your bank.

Yes. A withdrawal fee of RM2.00 (subject to SST) will be charged for every withdrawal. The withdrawal fee will be deducted from the withdrawal amount.

The minimum amount of money transfer is RM1.00, whereas the minimum amount of withdrawal shall not be less than the withdrawal fee (including SST).

The maximum amount of money transfer and withdrawal is subject to the transaction limits of PrestoPay.

PrestoPay is regulated by Bank Negara Malaysia (BNM) and complies to every standard and guideline issued by BNM. This helps to ensure your payment transactions and data are secure, as per the safest bank practices.

Please contact Presto Care at https://www.prestouniverse.com/my/contact-us available every Monday to Friday from 9am to 6:30pm.

Note: SST means sales and services tax as imposed under the Sales Tax Act 2018 and Service Tax Act 2018, as may be amended from time to time.

If you would like to grow your business by accepting payment via PrestoPay, please contact our team at https://www.prestouniverse.com/my/contact-us.

It is free to register as a PrestoPay Merchant.

You need to submit business/ company documents and relevant information to register as a PrestoPay Merchant. You may contact us via email at https://www.prestouniverse.com/my/contact-us and we will be in touch with you soonest possible.

PrestoPay is regulated by Bank Negara Malaysia (BNM) and complies to every standard and guideline issued by BNM. This helps to ensure your payment transactions and data is secure, as per the safest bank practices.

You may contact us at https://www.prestouniverse.com/my/contact-us and we will be in touch with you soonest possible.

The loyalty and rewards programme owned, operated and administered by BIGLIFE Sdn. Bhd. (Formerly known as BIG Rewards Sdn. Bhd. and Think BIG Digital Sdn. Bhd.)

Loyalty points that you can earn when you use your pre-assigned airasia Member ID at any of our participating partners or for other initiatives and programmes devised and/or managed by AirAsia and BIGLIFE from time to time.

- You will need to link your airasia rewards account in Presto

- Thereafter, you can start the shopping experience on Presto app

- At check-out, select PrestoPay as a payment method

- On the Payment Details screen, tap on add Loyalty Points, select airasia rewards and input the payment amount to activate usage as a payment

- Available payment value that can be used from airasia points will be auto calculated and displayed

- If the payment value from airasia points is not adequate, additional payment options will be available to complete the payment

- Click ‘Confirm & Pay’

airasia points Redemption (General):

- airasia points earned and/or issued in the Member’s Account including the balance of airasia points remaining therein up to 31st May 2019 will remain valid for a period of thirty-six (36) months from the date of issuance of such airasia points and it will automatically expire from the Member’s Account at the end of 36th consecutive month thereafter.

- Expired airasia points will be deducted and will not have any extension period or given a bigger time frame to use the unredeemed points unless otherwise determined by AirAsia and BIGLIFE.

Conditions for airasia points Redemption:

- Members Accounts must be active and not suspended or terminated at the time of a redemption request.

- Points that were used for redemption will be deducted by date of order and the airasia points that are close to expiry will be redeemed first followed by airasia points earned at a later date.

- AirAsia and BIGLIFE bears no responsibility for defects or deficiency in the goods or services supplied to you by any Merchants.

- Disputes concerning goods and services received as a reward under airasia rewards shall only be settled between Member and Merchant, service establishment or supplier. AirAsia and BIGLIFE will bear no responsibility to resolve such disputes or the dispute itself.

- Any redemption once accepted by AirAsia and BIGLIFE, cannot be revoked, cancelled, changed, returned or exchanged by the Member. Redeemed points will not be credited back in Member’s account.

You can tap on 'Add loyalty points' on the Payment Details screen, select airasia rewards and input the amount to be used in RM value. The maximum amount of airasia points that can be used is subject to the following conditions;

(a) Fifty per cent (50%) of airasia Member's airasia points balance under the linked airasia Member's airasia rewards account; or

(b) Up to five thousand (5,000) airasia points whichever is lower.

In the event of the full price of products and/or services redeemed by airasia Member as a form of payment through Presto, the conversion of the full price to airasia points shall be rounded up where applicable.

After the pre-set conditions have been applied, the minimum amount required to be used as a payment through Presto is 250 airasia points.

PrestoMall, Malaysia’s largest homegrown online shopping platform is now available for user to shop using airasia points. Stay tuned to our latest news for upcoming services that will be activated for airasia points as a form of payment.

Once a purchase has been made using airasia points as form of payment, no refund of airasia points is allowed, and any refund is strictly subjected to Presto’s refund policy as applicable.

Users can direct all queries, products and/or services related issues with respect to Presto and/or its respective merchants.

Email: support@prestouniverse.com

Operating Hours: Monday – Friday 9am-6:30pm

Presto App > Tap on Wallet > Balance will be displayed on airasia rewards tile ( if the airasia rewards account has been linked successfully)

Presto App > Tap on Wallet > Select airasia points tile > Click on Remove Account

Contact our Customer Care Team for further inquiries or disputes by going to your Presto App tap into [Account]>[Help]>[Email Us].

Send in your inquiries at support@prestouniverse.com.

Available Monday to Friday from 9am – 6:30pm.

There can be only one successful linked account at any given one time.

Illustrations for the benefit of doubt:

Presto account A linked with airasia rewards account A

And then,

Presto account B link with airasia rewards account A

In this scenario, Presto account B will be the account holder for airasia rewards account A

You can use PrestoPay E-Wallet Balance or PrestoPay Credits as an additional payment method if you lack insufficient airasia points for your purchase.

A consumer rewards membership programme run by BonusKad Loyalty Sdn. Bhd. (“BLSB”) Membership

Loyalty points that you can earn when you link your BonusLink Member Card to Presto and utilize points at any of our participating partners or for other initiatives and programmes devised and/or managed by Presto or BonusLink from time to time.

a) You will need to link your BonusLink Member Card in Presto

b) Thereafter, you can start the shopping experience on Presto app

c) At the checkout page, select PrestoPay as a payment method

d) On the Payment Details Screen, tap on Loyalty Points for the dropdown options and select BonusLink

e) Input the available amount to activate usage for payment

f) Available payment value that can be used from BonusLink Points will be auto calculated and displayed during checkout page

g) If the payment value from BonusLink Points is not adequate, additional payment options will be introduced to complete your payment.

A minimum of 100 BonusLink Points is required to begin using BonusLink Points as a form of payment.

100 BonusLink Points = RM1.00

Yes, you can adjust the amount of BonusLink Points used during the checkout payment process.

Yes, members are required to create a Presto Account to link with your BonusLink Account and begin earning and utilizing BonusLink Points.

Members are only allowed link up to one(1) BonusLink Account per Presto Account.

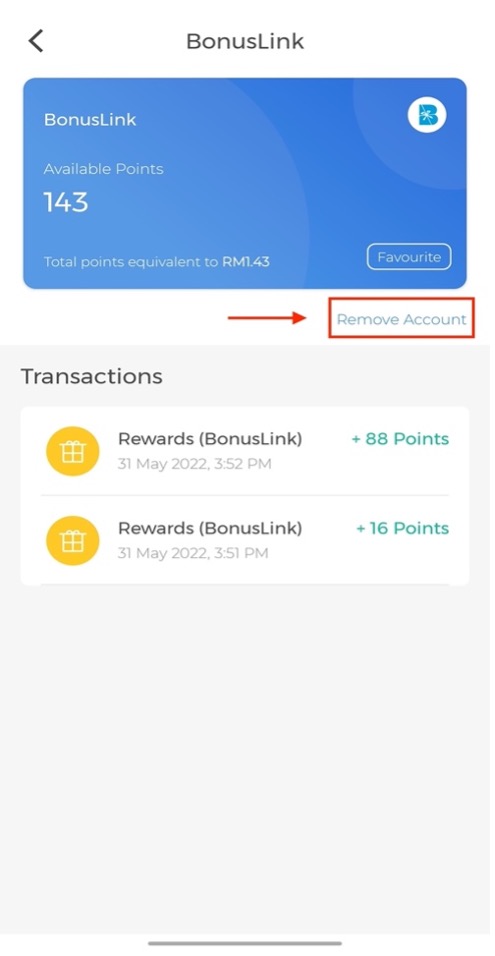

If there is a need to change or update your BonusLink Account details, members can do so by unlinking their current BonusLink Account via Presto and re-link to the BonusLink Account of their choice.

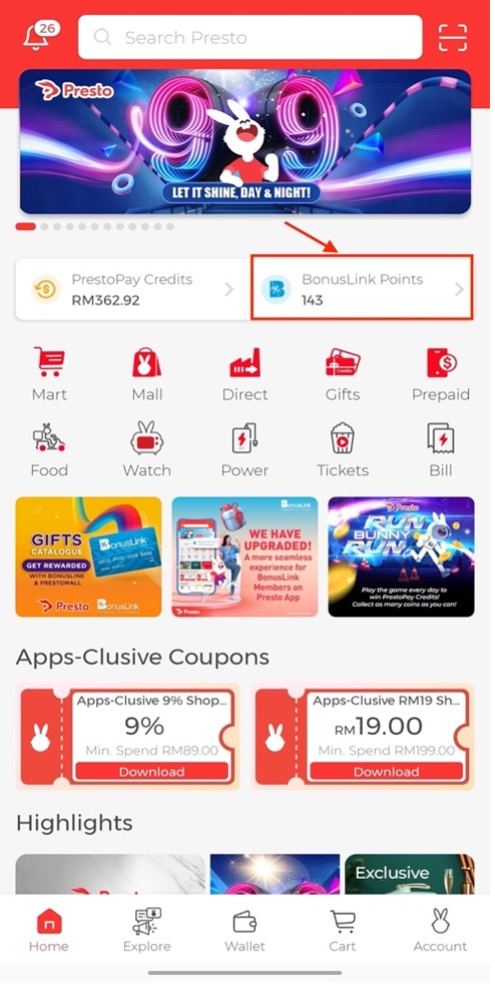

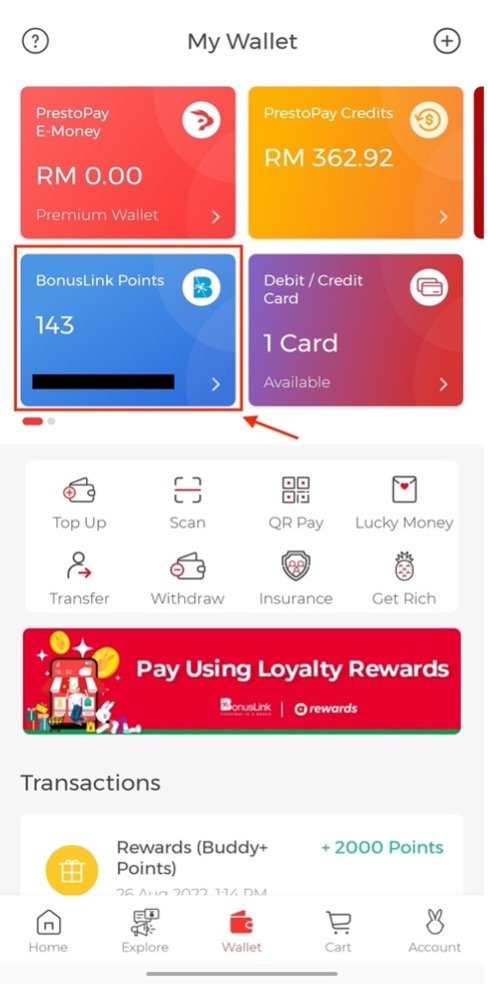

Access your BonusLink Account Details through either methods:

Remove BonusLink Account:

- Mart – Both online and in-store purchase

-

Mall – Shop at PrestoMall

-

Tickets – Purchase movies, marathon, and event tickets

-

PrestoPay E-Money

-

PrestoPay Credits

-

Debit Card

-

Credit Card

-

Online Bank Transfer

-

Boost

-

GrabPay

-

Touch ‘n Go

-

Alipay

Browse and shop on the Presto App where each item showcased will indicate the amount of points earned.

BonusLink Points are valid for 3 years. You will need to make redemptions within 3 years, otherwise the Points will expire on a monthly, ‘first in-first out’ basis.

Example, BonusLink Points collected in Jan 2019 will expire in Jan 2022.

BonusLink Points will be issued once your order has a “Purchase Confirm” status. This status is only applicable to products purchased on PrestoMall or via the Mall widget on Presto App.

Products purchased on PrestoMart via offline/online or on the Mart widget will be issued out upon checkout purchase.

Presto and BonusLink will host campaign programmes and promotions from time to time where users are able to earn more BonusLink Points during that period, so keep a lookout on Presto’s promotion blog to be updated on the latest news.

Please contact our Presto Care team here, available every Monday – Friday from 9am – 6:30pm.

Please contact our Presto Care team here, available every Monday – Friday from 9am – 6:30pm.

The standard currency issuance to customers for any refund requests will be in the form of PrestoPay Credits.